A strong credit score is one of the most important financial tools in the United States. Whether you’re trying to rent an apartment, buy a car, get a loan, or even qualify for certain jobs, your credit score plays a major role. Unfortunately, many beginners especially immigrants, students, or young adults struggle because they don’t know how credit works or how to build it strategically. The good news?You can significantly improve your credit score in just 60–90 days with the right steps. This guide explains exactly how credit works in…

Read MoreCategory: FInance

Best Budgeting Apps for Beginners in the USA

Introduction In the USA, managing money wisely is essential especially for beginners, students, new immigrants, and young professionals who want financial stability. With rising living costs, credit card bills, and monthly expenses, staying on top of your finances can feel overwhelming.This is exactly why many people search for the best budgeting apps for beginners in the USA, as these tools make it easier to track spending, save more, and build better financial habits. Thankfully, budgeting apps make money management easy.They help you track expenses, reduce overspending, save more, avoid debt,…

Read MoreKey steps to select the right trading platform in Forex

An online trading platform is a place for trading and is offered by your chosen broker. Traders should choose a platform that fulfills their demands. As a result of having access to a weak trading platform, people face various problems and lose money. So, it is necessary to choose the right trading platform. There are some steps to take to select the right trading platform. Let’s learn about these. Give Priority to Your Own Preferences If beginners try to imitate others and make a selection based on the opinions of…

Read MoreBecome a Good Forex Trader

Forex trading is a platform that allows you to make money. Many beginners go with the hype portrayed online and want to delve into the opportunities that come with forex trading without getting their feet wet first in learning what it takes, the risks involved and the methods to use into becoming a successful forex trader. It is vital to grasp all the basics first and you can only do that by learning from the best. Learning from the best allows you to understand the trading methods and markets. It…

Read MoreAre you eligible for a Credit Card? Check Credit Card Eligibility Checker

Credit cards seem to have become a staple payment option for the average joe in the UK. They make for a highly convenient payment method and come with a variety of valuable offers and benefits. Your eligibility for a credit card is typically determined by your expenditure pattern and the results of a credit card eligibility checker. If you are new to the world of credit, here is what you ought to know. Which Credit Card should you get? Selecting the right credit card is often easier said than done.…

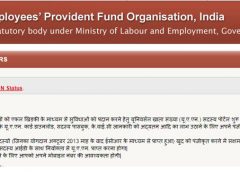

Read MoreKnow Your UAN status with your Member Id, PAN or Aadhaar

An employee who also commits to EPF can check his UAN status online on the official website of EPF for UAN by using his PF Number or Member Id or PAN or Aadhaar number. This article also describes the measures to Understand your UAN status. Know your UAN status by following the steps also described below. Overview of Steps to Know your UAN status The UAN is a 12-digit number given to each Employee Provident Fund division by the Employee Provident Fund Organization (EPFO). The UAN persists the same during…

Read MoreEPFO – Process to Transfer Online, Check Transfer Status

As an employee, you can provident fund, which is also known as Employee Provident Fund. But there are numerous questions which turn around this concept like what precisely it means, who gives to it and most importantly what results to the fund when you change your employment. If you are watching for answers to the question above, then this is the best place for you. We have briefly included the basics of EPF and EPFO in this blog. You will also get a complete guide on how you can transfer…

Read MoreSIP or Systematic Investment Plan: Simple Steps to follow

What Is A SIP? A SIP ( Systematic Investment Plan ) is an investing way that has taken the middle stage ever since the mutual fund industry has observed rapid growth. SIP is one of the ideal forms of investing in mutual funds and enables an investor to invest regularly thereby building on financial discipline. Systematic Investment Plan is a planned way of investing which benefits to inculcate the savings nature in an individual. In SIP, an individual is free to prefer the frequency of investments (such as quarterly, monthly…

Read MoreSalary Slips to manage your future and present aspects

Whenever salary day comes around, we often concentrate our attention towards the money we’re receiving for our services, yet we do not look at on our Salary Slips. It’s also an efficient way to manage our finances from monthly earnings. The salary slip contains very vital information that could be used to settle any future conflicts and other legal issues with the employer. The Relevance of Salary Slips A salary slip, also known as a payslip or a salary receipt in certain organizations, is provided to employees to brief them,…

Read MoreEverything You Need to Know About Your Salary Slip

What is a Salary Slip? A salary slip is a document issue by an organization to an employee. It also carries a detailed description of the employee’s salary components like HRA, LTA, Bonus paid, etc, and deductions for a specified time, usually a month. Employers lawfully attach to issue salary slips to their employees annually, as proof of salary payments to employees and deductions. For most people, the value of salary slips is only when they apply for a loan or a new credit card Otherwise, the difficult terms and…

Read More