An employee who also commits to EPF can check his UAN status online on the official website of EPF for UAN by using his PF Number or Member Id or PAN or Aadhaar number. This article also describes the measures to Understand your UAN status. Know your UAN status by following the steps also described below.

Table of Contents

Overview of Steps to Know your UAN status

The UAN is a 12-digit number given to each Employee Provident Fund division by the Employee Provident Fund Organization (EPFO). The UAN persists the same during the life of an employee. The employee will have various member Ids or PF numbers generated when he shifts the job. All these members Id’s are linked to the UAN of the worker to help the process of EPF transfers and withdrawals.

- Go to the UAN Portal: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Click on the button ‘Understand your UAN Status’

- Choose whether you want to enter PF number or Member Id or PAN or Aadhaar.

- If you Select Member Id then you have to take State and Office and enter your Member Id.

- Access other details such as name, date of birth, mobile no, captcha code.

- Click on ‘Get Authorization Pin’.

- You will also get a PIN on your mobile number. Enter the PIN and click on the ‘Approve OTP and get UAN’ button.

- You will see a note that Your UAN number and status will be sent to your mobile number.

Steps to Know your UAN status

- Go to the UAN Portal: https://unifiedportalmem.epfindia.gov.in/memberinterface/

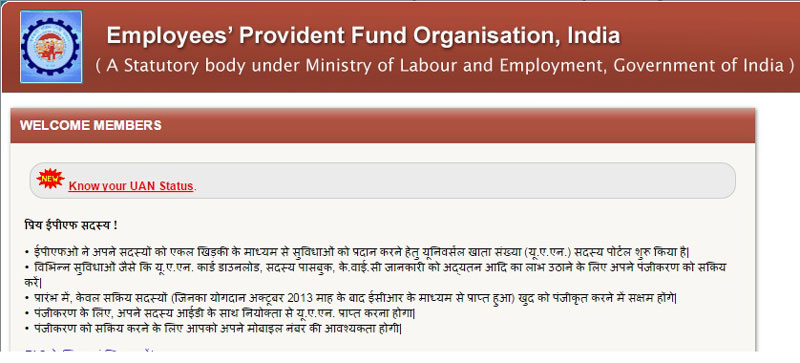

- You will notice the window

- Choose whether you require to enter Member Id or PAN or Aadhaar

- If you also choose Member Id, you need to choose state and EPFO office.

- Member ID or PF Account Number is in the form given below. Ex: For someone who operates in Bangalore the code can be BG/BNG/012345//789.

- EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit)

- If your PF Account Number does not have an Extension code. Then enter 000

If you choose Aadhaar or PAN then start just Aadhaar or PAN.

KYC Updation

The KYC details carry PAN card, Aadhaar card, and bank account details. KYC update in EPF gives the following advantages.

- The proper KYC document finished account does not face any obstacle during the transfer or withdrawal of money.

- If bank account information is also not updated your request may get denied.

- Know your UAN status register Member Id/UAN/PAN

- Enter additional details such as name, date of birth, phone number, email id, verification code. (the alphabets which in above picture M5G24, they will vary in yours)

Also Read: What is EPF? What is EPFO? What is UAN?

Know your UAN:

Use the corresponding mobile number which you have provided to your employer or which is linked with your Aadhaar, else you will get error Mobile Number does not match with the given data.

- Know Your UAN status mobile number does not verify

- If the data are fine, you can also Click on Get Authorization Pin. The button will turn to Validate OTP and get UAN

- Please verify the Disclaimer. The mobile number is recorded. Click on I Agree this is very essential to know your UAN Status.

You will get a PIN on your mobile number. Enter the PIN that receives on your given phone number and click on Validate OTP and get the UAN button.

- Know your UAN status Validate OTP

You will notice a message that

- Know your UAN status message

You will get the information on your mobile related to one shown below(if your UAN is active)

- Know your UAN status mobile message