Table of Contents

What is a Salary Slip?

A salary slip is a document issue by an organization to an employee.

It also carries a detailed description of the employee’s salary components like HRA, LTA, Bonus paid, etc, and deductions for a specified time, usually a month. Employers lawfully attach to issue salary slips to their employees annually, as proof of salary payments to employees and deductions.

For most people, the value of salary slips is only when they apply for a loan or a new credit card Otherwise, the difficult terms and figures seem like a problem you don’t want to solve. But here’s why you might want to know your salary slip better.

- Prefer smartly from competing for offers when you are looking to switch jobs

- Optimize tax burden by making full use of the deductions available

- Know what percentage of your salary is savings (EPF, ESI etc.)

Types of Salary Slips

- Manual Payslip

- Computerized Payslip or E-Payslip

With respect to the type of salary slips issued first off in the era of papers and also file type mode of running offices, a manual salary slip used to process. These manually prepared payslips used to include the company’s seal, the signature of the authorizing official as well as the logo of the business.

Nowadays, also with paperless offices technology and digitalization, the process for the creation of the salary slip has been automated. Computerized payroll or E-payslip has also streamlined the method.

Employees are free to take printouts of the slips as and when they want. However, they can just use pdfs wherever as proof of employment and for a loan application, credit cards etc.

This also automated method of creating the payslip is faster, more effective and also assures the security of the data.

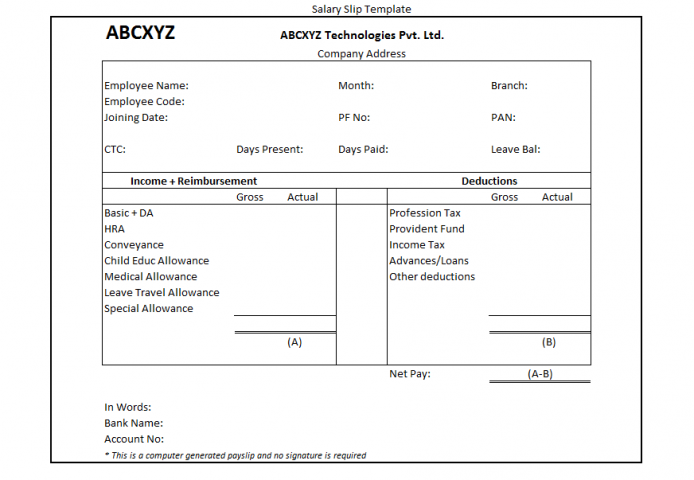

Salary Slip – Sample Template

Income

Basic Salary: Typically,

Between 40-60% of your CTC, is fix component of your wages and is the basis on which HRA, EPF, Reward etc

Typically, between 40-60% of your CTC, fix component of your wages and is the basis on which HRA, EPF, Reward, etc

House Rent Allowance (HRA)

House Rent Allowance is also normally 40-50% of your basic salary. This has tax assumptions, and if you are also living in leased accommodation and getting HRA, tax exemption is the least among

– HRA got

– 50% of basic salary also for those residing in metro cities (40% of basic salary for non-metros)

– Exact rent paid

Transport/Vehicle allowance

Most companies also have this at Rs. 1,600 per month (Rs. 19,200 per annum), which is the greatest tax-deductible amount. You don’t require to submit any bills.

Children Education Allowance

The actual amount paid differs across companies, but up to Rs. 100 per month per child up to a maximum of 2 children is excluded from tax.

Medical allowance

This also allowance is often fixed at Rs. 1,250 per month (Rs. 15,000 per year) – the maximum amount which you can also claim as payment if you submit bills incurred on medical expenses for self or dependents. If no bills are offered, the entire amount is also added to your taxable income.

Leave Travel Allowance (LTA)

The amount under this also cover can be claimed as a tax deduction double in a block of four years. The current block is also from 2018-21. You must submit bills for travel acquired by you or with your dependents also .

Bonus/Performance allowance

An expense-paid also depends on your performance. This can be a fixed or variable amount paid every fourth or six months or even annually.

Special Allowance

Largely a balancing figure once amounts have been designated under all other heads of income.

Employee Contribution to Provident Fund

Provident Fund is a government plan also meant to incentivize savings. An organization with 20 or more workers is also required to subscribe to this scheme (they can claim exemption too). The contribution each month is 12% of your basic salary, which is also equalled by your employer and deposited to your provident fund account.

Some companies may also prefer to keep this contribution at the minimum level i.e. 12% of a basic of Rs. 15,000, which is Rs. 1,800 per month, leaving a higher take-home salary for workers.

Income Tax/Tax Deducted at Source

This is the amount decreased towards payment of income tax. At the beginning of the financial year, you are also needed to submit a declaration to your company’s accounts department, giving an evaluation of your tax-saving investments for the year. Based on this, your tax liability is also determined and deducted every month.

Most companies needs you to submit proof of investments by first month of year so that tax liability can be recalculated if also required, and the extra amount can be adjusted in salary payable from January to March. You can also overcome this burden by saving tax under Section 80Cor other sections beyond 80 C.

Loans/Advances

If you avail of a loan or advance from the company, the installment decreases every month and is considere here.

The salary slip is also usually used as income proof when you’re applying for a loan or credit card.

Best Points about your Salary Slip

- Your Basic salary is the most significant allowance as all other allowance and PF deduction is based on this allowance.

- You can decrease the Income Tax component by investing money in tax saving instruments.

- Your take home salary and CTC is not the equivalent. CTC is much higher than take home as CTC amount involves multiple other advantages like free food transport, health insurance etc.

- Salary slip is necessary to document, it is suggested to preserve a copy of past six-month Salary Slips

- You should verify income and deduction specified in salary slip and in case of discrepancy kindly contact accounts and HR department promptly.

- Salary slips help you adjust the compensation in front of your new proposed employers.

- Authentic proof of income which can maintain file income tax return filing.

- Salary slips can be recognized as proof of PF (Provident Fund) same as insurance and allowance deductions.

- Salary slips help in conducting background checks while changing jobs or while using for higher education.